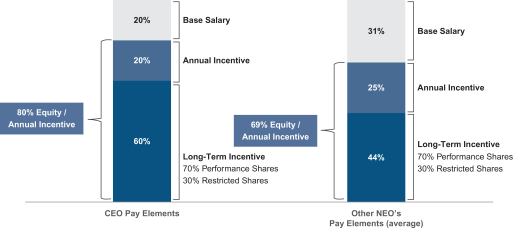

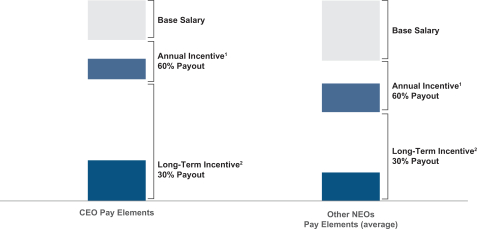

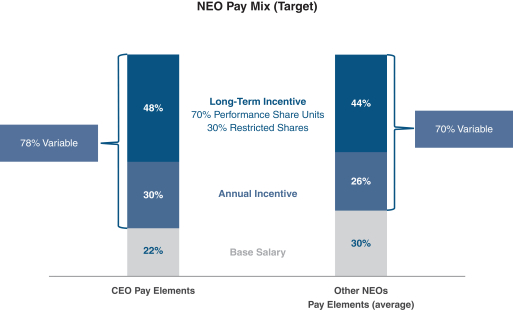

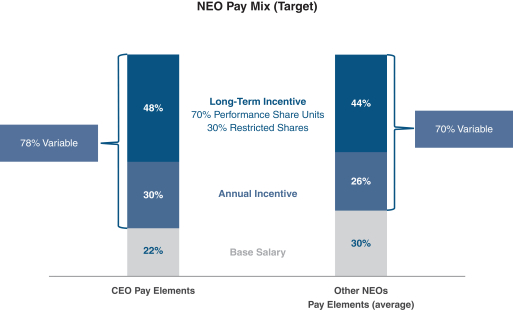

(1) | Fiscal year 2020 goals for our NEOs were initially set in February 2020, prior to the onset of the COVID-19 pandemic, at which time the Company started the year strong, demonstrated by its solid performance in the first quarter. Given the duration and severity of the pandemic, our clients’ businesses were deeply impacted, which had a direct, negative impact on our 2020 revenues and margin. However, the long-term fundamentals of our business remain strong and we believe we are well-positioned strategically, financially and operationally, to respond to the market opportunities that will result from the ongoing pandemic. The 2017Compensation Committee assessed the unprecedented impact of the pandemic, overall Company performance, individual contributions, and the preservation of shareholder value when determining actual payout results for 2020. As discussed in more detail below in “NEO 2020 Compensation”, the Committee took a holistic approach to its assessment of NEO pay and: 1) did not make any changes to outstanding long-term incentive awards, 2) reprioritized Strategic Measures when determining annual incentive award paid out at 60.2%payouts and 3) chose to fund modest NEO cash bonus awards to align the NEOs with other corporate team members. The plan design for 2020 aligned NEO interests with those of target.the shareholders by having a significant portion of NEO compensation as performance-based and at-risk. The table below illustrates the 2020 target mix of pay for the NEOs. |

(2) | The value of the 2017 long-term incentive reflects both a lack of payout on the Adjusted EPS component and the decline in our share price, with earned shares valued at the 12/31/17 price of $40.45.

|

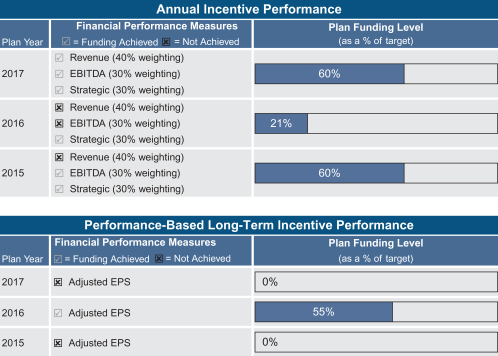

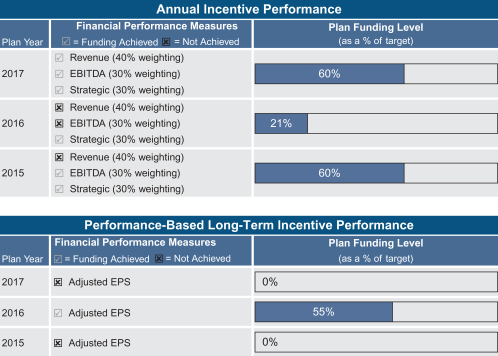

Our pay programs create alignment between Company performance and NEO pay, as illustrated for the prior three years in the tables below. Our annual incentives yielded payouts below target in each of those years, and our long-term incentive program has only provided a payout in one year, but at a below target level.

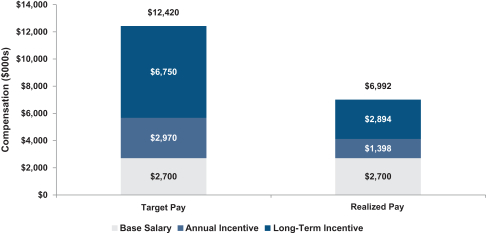

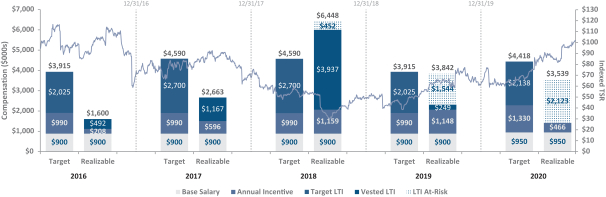

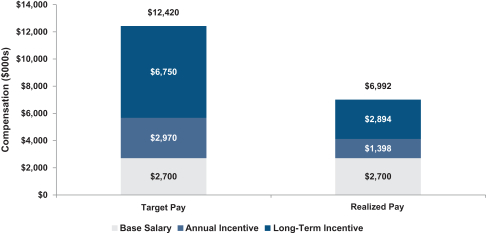

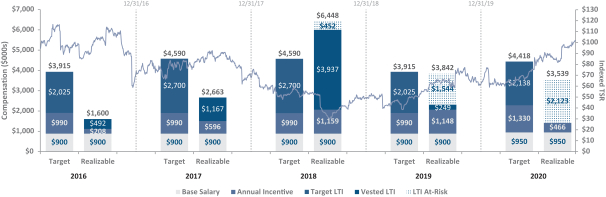

Our executive compensation programs are veryprogram is directly aligned with shareholder value. This alignment is reflected in a comparisonclearly evident when comparing the target pay to the realizable pay of Mr. Roth’s target and realizable compensation.our NEOs. The graph below illustrates the target compensation opportunity provided to Mr. Roth for 2015-2017from 2016-2020, the compensation he has earned, and the equity compensation he still has the potential to earn from awards granted from 2016-2020. The realizable compensation values are compared with our TSR performance over the same period. Realizable pay includes salary, actual annual incentive earned, and equity incentives earned or remaining eligible to be earned, valued at the December 31, 2020 share price. Seventy percent of our NEOs’ Long-Term Incentive (LTI) opportunity is at-risk. Beginning with the LTI grants in 2018, these at-risk awards are only eligible to be earned if the Company achieves rigorous predetermined Adjusted Diluted EPS and Revenue Growth goals over a full three-year performance period. 2018, 2019 and 2020 at-risk LTI is eligible to be earned after the completion of the 2018-2020, 2019-2021 and 2020-2022 performance cycles, respectively, based on actual results. The value realized, when taking into account performance achievements under our incentive programs as well asof these awards will depend on the portion, if any, earned and the share price changes. Mr. Roth realized 56% of his target pay opportunity over the 2015-2017 period. 3-Year Aggregate CEO Pay ($000s)

(2015-2017)at that time.

| (1) | Target Pay reflects the sum of the target compensation levels, including base salary, target annual incentive and the grant date fair value of equity provided in each of 2015, 2016, 2017, 2018, 2019 and 2017.2020. |

| (2) | RealizedRealizable Pay reflects the sum of actual base salary paid, actual annual incentive earnedpaid, and long-term incentive awardthe value forof LTI awards granted in 2015, 2016, 2017, 2018, 2019 and 2017. The value of the long-term incentive reflects actual performance for completed performance periods and target performance for outstanding performance cycles, with all awards2020. All equity is valued at the $40.45$58.95 share price as of 12/31/20. Specifically for the PSUs:

|

| (a) | The performance-based awards granted in 2016 had two tranches. The 2016 tranche vested at 55%. The second tranche was forfeited, resulting in a total payout of 25% of the target award value. |

| (b) | The performance-based awards granted in 2017 were unearned and forfeited. |

| (c) | The 2018-2020 performance-based awards were earned at 102% of target. |

| (d) | The 2019-2021 performance-based awards are assumed at 67% of target, which is the level of performance at which these awards were tracking as of 12/31/20. |

| (e) | The 2020-2022 performance-based awards are assumed at target because there are two years remaining in the performance cycle, and the outcome is uncertain. In order for these awards to be earned, the Company must achieve significant growth in Adjusted Diluted EPS and Revenue that the Committee approved prior to the onset of the year-endCOVID-19 share price.pandemic. |

| | SECTION 2 - COMPENSATION PROGRAM OVERVIEW |

Huron’s executive compensation program is structured to align executive pay with Company performance. The strength of this alignment was recognized by our shareholders in 2017 as Huron received over 99% support on our shareholder advisory vote on executive compensation (commonly referred to as “Say on Pay”). We strive to provide compensation to motivate and reward performance that is in the long-term best interests of our shareholders. We define performance as a blend of: Delivering value to shareholders; Achieving financial performance in comparison topre-established financial goalsgoals; and Attaining strategic initiatives that we believe are responsive to changing conditions and critical to future value creationcreation. Delivering value to shareholders

As part of the program, we also evaluate several groups of peers depending on what we are measuring:

For executive compensation, we use a peer group of publicly traded companies (“Executive Pay Peer Group”) where the size of the companies and the roles of the executive officers are similar to those of Huron. We generally seek to target executive pay at the market median and in alignment with the pay data from this peer group. This pay data may at times be supplemented with broader survey data for specific executives, as appropriate.

For compensation of our client-facing managing directors (“Managing Director Peer Group”), we gather data from public and private companies and focus our comparators on the type of work performed, rather than primarily on the size or public/private nature of the organizations.

In order to assess our business performance, we review our business competitors, many of which are private, much larger in size or are subsets of larger companies. Therefore, obtaining comparative business results can be challenging. As a result, we have chosen to set executive performance goals based on absolute rather than relative performance measures.

In addition to these objectives, we adhere to a comprehensive set of generally accepted best practices in the structuring and design of the compensation program.

| | | Best Practice Elements: | | | | | | •

What We Do | | | | Establish Competitive Compensation Levels.

What We target the total direct compensation for our NEOs at levels that are generally within +/- 15% of market median total direct compensation levels and tie actual compensation to performance.Do Not Do | | ✓ | | •Provide competitive target pay opportunity - with a significant majority at-risk and based on objective financial performance measures

| | û | | Maintain a “Double Trigger.”In the event ofProvide excise tax gross-ups

| | ✓ | | Provide only double-trigger benefits in a change of control severance benefits are paid, and equity awards vest, only if our NEOs incur a qualifying termination. | •event

| | û | | Allow any hedging or pledging of Huron stock | | ✓ | | Annually review our programs for inappropriate risk | | û | | Allow stock grants to be “timed” or awards to be repriced | | ✓ | | Maintain robust, competitive stock ownership guidelines, including an increase as of 2019 to 5X for the CEO and directors, and a requirement that 60% of after tax shares be held until the guidelines are met | | û | | Provide executive perquisites not commonly available to the broader Huron employee population | | ✓ | | Maintain a clawback policy providing for recoupment of incentive-based compensation if payouts were based on misstated financial results | | | | | | ✓ | | Retain an independent compensation consultant to the board | | | | | | ✓ | | Solicit investor feedbackMinimize Compensation Risks.We periodically reviewon our compensation program to confirm that our compensation policies and practices are not encouraging excessive or inappropriate risk taking by our NEOs. | •potential enhancements through an extensive shareholder engagement program

| | Impose Robust Stock Ownership Guidelines.Our stock ownership guidelines require our NEOs to retain a significant equity stake in the Company. NEOs are expected to retain a number of shares equal to at least 60% of the net after tax value from the exercise of stock options or vesting of restricted shares and performance shares until these guidelines are met.

| •

| | Maintain a “Clawback” Policy. We maintain a compensation recoupment policy (commonly referred to as a “clawback policy”), which generally provides that the Company may recover performance-based compensation paid to NEOs and such other individuals designated by our independent directors, if payout was based on financial results that were subsequently restated.

| •

| | Retain an Independent Compensation Consultant. The Compensation Committee retains an independent consultant to assist in developing and reviewing our NEO compensation strategy and to confirm that the design and pay levels of our compensation programs are appropriately consistent with our goals and market practices.

| •

| | Consider the Impact of Tax and Accounting Rules. The Compensation Committee takes into account the effect of tax and accounting rules in structuring our NEO compensation program. The Compensation Committee reserves the right to pay compensation that may not be deductible under Section 162(m).

| •

| | Review Share Utilization. We regularly review overhang levels (the dilutive impact of equity awards on our shareholders) and consider such levels in our consideration of future equity grants.

| •

| | No Excise TaxGross-Ups. Our NEOs are not entitled to receive any“gross-up” payments related to excise taxes that may be imposed in connection with golden parachute arrangements under the Company’s change of control severance plan.

| •

| | Hedging or Pledging of Company Stock. The board has adopted a revised Insider Trading Policy that prohibits directors, officers, employees, and contractors from hedging activities, holding Company securities in a margin account or pledging Company securities as collateral for a loan.

| •

| | No “Timing” of Equity Grants. We maintain a disciplined equity approval policy. We do not grant equity awards in anticipation of the release of material,non-public information. Similarly, we do not time the release of material,non-public information based on equity grant dates.

| •

| | No Executive Perquisites that are not provided widely at Huron. We do not provide material benefits or perquisites to our NEOs that are not provided widely within Huron.

|

Shareholder Outreach We engage in a proactive outreach effort with our shareholders on a regular basis throughout the year. Select members of our board of directors and management team engage with our shareholders to seek their input and perspectives and help increase their understanding of our business, our growth strategy, our commitment to our people and culture, including inclusion and diversity, our executive compensation philosophy and program, and corporate governance, environmental and social issues. Throughout 2020, we engaged with shareholders representing a significant percentage of our outstanding shares. These conversations primarily focused on the evolution of the Company’s strategy and the impact of COVID-19, our ongoing refresh process for the board of directors, including how we will continue to foster diversity among board members, and environmental, social and governance factors. We heard no concerns regarding our NEO pay programs. Our independent Chairman and the chair of the Compensation Committee were available for consultation with our major shareholders. The feedback received through our shareholder outreach efforts is communicated to and considered by the board and, when appropriate, informs our decisions and strategy. For example, our current executive compensation program reflects specific feedback that we received during our 2018 and 2019 shareholder outreach efforts. The 2020 executive compensation program remains largely unchanged from 2019. 2020 Say on Pay Vote At the 2020 Annual Meeting, approximately 92% of votes cast were in support of the named executive officer compensation. We view this overwhelming support of our compensation programs as a reflection of the strong alignment between our executives’ pay and shareholder value, as well as the strength of the program design changes that we made during 2018 and 2019. We will continue to listen carefully to our shareholders and incorporate their feedback into our deliberations about executive compensation. | | SECTION 3 - NEO COMPENSATION PROGRAM DETAILS |

Targeting of Total Direct Compensation The Compensation Committee generally targets total direct compensation to be within+/-15% of the median of the Executive Pay Peer Group for our NEOs. TheIn addition to peer group data, the Compensation Committee also reviews survey data for companies with revenues between $500 million and $1 billion from the Radford GroupGlobal Technology SurveySurvey. The Compensation Committee considers Huron’s competition for talent for the NEOs as well as our managing directors to be broader than just the peer group companies, with annual revenue between $500Mincluding other public and $999.9M. This data informs the Committee’s decisions on pay adjustments. 2017 Base Salary, Annualprivate consulting, strategy and Long-Term Incentive Changes

During 2017,technology organizations. When making compensation determinations, the Compensation Committee approved changes to bothconsiders the 2017 Annualadvice of our independent compensation consultant and Long-Term Incentive Plans. These changes were made with the goal of continuing to evolveapplies its judgment in incorporating these and improve the programs with the organizational needs of the Company, while ensuring a clear correlation between pay and performance, and effectively motivating the NEOs toother factors.

out-perform2020 NEO Compensation Opportunity expectations.

The Compensation Committee approved 20172020 compensation levels (base salary and target annual and long-term incentive) in February of 2017.2020: | | | | | | | | | | Compensation Element | | James H. Roth | | C. Mark Hussey | | John D. Kelly | | Diane E. Ratekin | Base Salary | | $900,000 | | $750,000 | | $325,000 | | $400,000 | Target AIP Payout | | 110% of base salary | | 100% of base salary | | 70% of base salary | | 50% of base salary | Target LTI Payout | | 300% of base salary | | 175% of base salary | | 100% of base salary | | 115% of base salary |

For 2017, theMr. Roth’s base salary was increased from $900,000 to $950,000, and his annual incentive opportunity was increased from 110% to 140%. The Compensation Committee increased chose to increase Mr. Roth’s target total cash compensation opportunity for the first time in six years to reflect his performance. This change brings his target cash opportunity just above market median of the peer group and puts 78% of Mr. Roth’s pay at-risk based on Company performance.

Mr. Hussey’s base salary was increased from $750,000 to $750,000 from $600,000$800,000 to recognizereflect his performance his leadershipand integral role in driving the creation of Huron’s long-termCompany-wide strategy as President and his increased role leading the transformation of the Healthcare practice. They also increased Mr. Roth’s target LTI to 300% from 225% and Ms. Ratekin’s target LTI to 115% from 100% to be more market competitive, and increased COO. Mr. Kelly’s total compensation by 105% to compensate for his promotion to Chief Financial Officer from Chief Accounting Officer. For 2018, the Compensation Committee increased Mr. Kelly’s total compensation by 32% to be more market competitive. Hisbase salary was increased from $325,000$460,000 to $400,000$525,000, and his LTItarget annual incentive opportunity was increased from 70% to 90% of his base salary. These changes were part of the Compensation Committee’s multi-year strategy to transition his pay closer to the market median. The Committee also awarded Mr. Kelly a targetgrant of 100%12,639 shares of restricted stock that will cliff vest after four years, provided Mr. Kelly is still in service to 120%.Huron, to offer added retention given his outstanding performance and his critical importance to the Company.

The Compensation Committee approved Mr. Torain’s compensation when he was hired on March 1, 2020, including a grant of 2,301 shares of restricted stock that will vest annually over three years, provided Mr. Torain is still in service to Huron. The Compensation Committee will continue to review NEO compensation for comparability and competitiveness on an annual basis. | | | | | | | | | Compensation Element | | James H. Roth | | C. Mark Hussey | | John D. Kelly | | Ernest W. Torain, Jr. | Base Salary | | $950,000 | | $800,000 | | $525,000 | | $360,000 | Target AIP Opportunity (% of Salary) | | 140% | | 100% | | 90% | | 50% | Target LTI Opportunity (% of Salary) | | 225% | | 175% | | 150% | | 90% |

20172020 Annual Incentive

The Compensationfinancial goals approved by the Committee in February 2020 were consistent with our pre-COVID-19 growth objectives across all of our segments. The impact of COVID-19 on our clients’ businesses negatively affected demand for our services and made achievement of our financial goals established pre-COVID-19 nearly impossible under the circumstances.. While the Strategic Measures the Committee approved in February remain important for our continued success and are a performance-based Annual Incentive Plankey focus for 2017. The maximum incentive opportunity for 2017 increased from 125% to 150%our NEOs as part of target to better align with market practice and to enhancetheir annual goals, the incentives for participants to achieve maximum performance levels. Based on the actual results on eachonset of the performance measures, a total annual cash incentive payoutpandemic and its impact on our clients, communities, and employees required reprioritization to reflect changing business focus areas and the extraordinary circumstances caused by the pandemic. After the onset of 60%the pandemic, the Committee and management reviewed the original Strategic Measures and the Committee approved updated priorities that reflected repositioning of target was earned. This amount is reflected in the Summary Compensation Table asNon-Equity Incentive Plan Compensation.

This plan is structured as shown in the table below:

| | | | | | | | | | | | Performance Measure | | Weighting | | Threshold | | Target | | Maximum | | Actual | Net Revenue | | 40% | | $729M | | $759M | | $829M | | $733M | Adjusted EBITDA Margin | | 30% | | 14.3% | | 15.2% | | 16.0% | | 14.3% | Strategic Measures* | | 30% | | Committee Discretion | | 100% | | 150% | | 125% |

* The Committee reviewed and discussed the NEOs’ performance againstfocus in order to preserve shareholder value and position our business for future success. The updated Strategic Measures expanded the strategic measures that were established at the beginning of the year. The Committee identified overachievements against certain objectivesgoals to incorporate quantitative and determined the overall level of performance resulted in a payout on the strategic measures of 125% of target.

Note: A performance threshold of $0.05 Adjusted Diluted EPS which must be exceeded prior to the payout of the 2017 Annual Incentive Plan is designed to comply with the terms of Section 162(m). If $0.05 Adjusted EPS is exceeded, the Compensation Committee can approve a payout of up to 150% of target. The $0.05 Adjusted Diluted EPS was exceeded in 2017.qualitative

COVID-19 specific measures while reweighting the original Strategic Measures set in February 2020. After the end of the year, the Committee reviewed performance against the Strategic Measures and determined achievement of 176.7% of target, resulting in a total payout of 35% under the annual incentive plan. These Strategic Measures are detailed below: | | | | | | | | | | | | | | | | 2020 Proposed Targets | Performance Measure | | Weighting | | Threshold | | Target | | Maximum | | Actual | | Payout %

of Target | Organic Revenue Growth | | 40% | | $890M | | $940M | | $990M | | $844M | | 0% | Adjusted EBITDA Margin | | 40% | | 11.15% | | 12.40% | | 13.65% | | 10.30% | | 0% | Strategic Measures* | | 20% | | Varies by measure - details below | | 176.7% |

| * | The structure of the Strategic Measures balances objective, quantifiable metrics with qualitative goals. The Compensation Committee approves the goals and assesses performance against predefined measures of success. Payouts range from 0-200% with a 25% minimum threshold. The following chart outlines the 2020 goals as well as their weighting, description and actual level of achievement. |

2020 Strategic Measures | | | | | | | | | | | | | | | Quantitative

Goals | | Weighting | | Alignment of Strategic Priorities with

Shareholder Value | | Level of Achievement | Enterprise | | 40% | | Focused on the deployment of capital and maintaining a strong balance sheet with appropriate leverage and flexibility to support Huron’s growth strategy, maintaining an engaged, productive workforce through the global pandemic, the growth of Huron’s commercial business, and the implementations of key system upgrades. | | | 76% | | | Executed Huron’s debt pay down strategy to de-leverage to below our target of 1.5x Adjusted EBITDA while managing cash flow to maintain liquidity in a period of uncertainty stemming from the COVID-19 pandemic. Consistently maintained employee engagement scores above the global norm. Exceed growth targets for revenue generated in Huron’s core commercial industries year-over-year. Successfully executed the implementation of Huron’s new ERP system on-time and on-budget and refreshed the company website. | Business Unit | | 7% | | Focused on achieving sustainable organic revenue growth over time. Measures included business unit-level revenue growth targets, new service line revenue growth targets, and collaboration metrics. Specific goals vary by business unit. | | | 2% | | | Executed Huron’s strategic plan, which included advancing and evolving new service lines to strengthen and expand our offerings and continuing to pursue collaboration within and across business units. Did not achieve all of the aggressive business unit growth measures due to the impacts of the COVID-19 pandemic. | | | | | Qualitative

Goals | | Weighting | | Alignment of Strategic Priorities with

Shareholder Value | | Level of Achievement | Enterprise | | 49% | | Focused on ensuring the health and safety of our people and managing our business to the best of our ability during the global pandemic and sustaining organic growth over time through the advancement and execution of Huron’s five-year strategic plan. Measures primarily included COVID-19 initiatives focused on keeping our people safe while also meeting the needs of our clients and people. | | | 94% | | | Developed a flexible COVID-19 safety and continuity plan that met the needs of our clients and our people. Provided additional support to our people to help them manage through the pandemic professionally and personally. Invested in areas focused on growth, collaboration and efficiency, including innovative services to address our client’s challenges stemming from the COVID-19 pandemic; Huron’s growth priorities and enterprise capabilities; and the advancement of the Company’s commercial strategy to further integrate and scale our businesses to accelerate growth. | Business Unit | | 4% | | Focused on strategically positioning Huron to achieve sustainable organic revenue growth over time, including advancing our growth priorities and capabilities that align with Huron’s enterprise-level strategy, ensuring customer satisfaction and high-quality delivery while balancing growth and strengthening our leadership key areas. Specific goals vary by business unit. | | | 4% | | | Areas of focus included successfully launching new service lines, advancing our practice strategies, and further developing leaders to accelerate growth in several key areas. | Total | | 100% | | | | | 176.7 | % | | |

Non-executives participate in annual incentive award opportunities tied to a variety of Business Unit and corporate performance metrics. The broader corporate bonus pool funded at 65% of target in 2020. In recognition of the significant challenges 2020 presented, the broader corporate bonus pool funding level and the NEOs’ leadership in achieving this broader performance, the Committee determined it would be inconsistent with the Company’s compensation philosophy to penalize or disproportionately reward the NEOs compared to other executives. The NEOs were critical in developing the Company’s response to the impact of COVID, positioning our Business Advisory segment to achieve record revenue in 2020, and deploying resources to develop innovative solutions to assist our clients, generating $30 million in revenues from new services. Therefore, the Committee approved cash bonus for the NEOs’ 2020 equal to 30% of target to provide a total 65% of target payout for the NEOs under the annual incentive program. Further, the NEO annual incentive program requires that awards be capped at target if the Company’s absolute total shareholder return during the year is not positive. This feature was not relevant to the 2020 annual incentives, which provided for a below-target payout. 2017Outstanding PSUs

There were three outstanding PSU cycles during 2020, those granted in 2018, 2019 and 2020. Each of the PSU cycles reflect 70% of each NEO’s target long-term incentive award opportunity and are determined based on performance against two predetermined absolute three-year goals (Adjusted Diluted EPS weighted at 40% and Revenue Growth weighted at 30%) The Committee did not make any adjustments to these outstanding awards, despite the significant unforeseen negative impact of COVID-19 on the estimated payouts for the NEOs. | | | | | Performance Cycle | | Estimated Payout as a % of

Target - Performance Through

12/31/19 | | Payout as a % of

Target - Performance Through

12/31/20 | 2018 - 2020 | | 137% | | 102% | 2019 - 2021* | | 170% | | 60% | 2020 - 2022* | | N/A | | 0% |

| * | 2018-2020 is actual payout, 2019-2021 and 2020-2022 is an estimated payout. |

2020 Long-Term Equity GrantsIncentive On March 15, 2017, Huron made1, 2020, the Compensation Committee granted our NEOs long-term equity grantsincentive awards that were structured as 70% performance units and 30% restricted shares. | | | | | | | | | Executive | | Performance Units

Granted* | | | Restricted Shares

Granted | | James H. Roth | | | 46,210 | | | | 19,804 | | C. Mark Hussey | | | 22,463 | | | | 9,627 | | John D. Kelly | | | 5,562 | | | | 2,384 | | Diane E. Ratekin | | | 7,873 | | | | 3,374 | |

| | | | | | | | | | Executive | | Performance Units Granted (1) | | | Restricted Shares Granted (2) | | James H. Roth | | | 25,215 | | | | 10,806 | | C. Mark Hussey | | | 16,515 | | | | 7,078 | | John D. Kelly | | | 9,290 | | | | 3,981 | | Ernest W. Torain, Jr. | | | 5,220 | | | | 2,237 | | Diane Ratekin | | | 0 | | | | 2,326 | |

*(1) | FullMr. Torain’s restricted and performance unitshares were awarded on April 1, 2020, using the $43.45 closing price of Huron stock on grant at target performance.date.

|

| (2) | Does not include special time-vested awards for Messrs. Kelly and Torain, as disclosed in the Grants of Plan-Based Awards table in this filing. |

In August of 2017, the Compensation Committee awarded Mr. Hussey an award of restricted shares with a grant date fair value of $1,000,000 in order to recognize his contributions as the interim leader of the Healthcare practice during its ongoing transformation as well as his critical role to the ongoing success of the business.

Restricted StockPerformance Unit Awards

The restricted stock granted to our NEOs vest 1/3 per year over three years, based on continued service to ensure retention. In addition,Performance units may be earned and settled in shares at the Company must exceed $0.05 Adjusted EPS in the yearend of grant or the awards will be forfeited. This condition is designed to satisfy the provisions of Section 162(m). This condition was met in 2017.

Performance Share Awards

The performance share awards are tied to both three-year performance and annual performance. The performance share plan was redesigned for 2017, following the completion of the initial three-year performance cycle (2014-2016). The 2017 performance share plan maintains theone-year performance period (60% of award) and a full three-year performance period, (40%depending on the level of award).performance achieved. Theone-year performance is measured 100% basedunit program was redesigned beginning with awards granted in 2018, and the 2020 awards relied on 2017the same structure as the prior two years. The Committee approves three-year absolute goals for both Adjusted Diluted EPS and any earned sharesRevenue Growth, including

establishing a threshold level below which no performance units will vest ratably over three years. The new three-year performance period will be measured 100% based on 2019 Adjusted Diluted EPS, and any earned shares will immediately vest on March 15, 2020, aftervest. These goals are communicated to the NEOs at the time of grant, but we do not share them publicly until the end of the performance period to prevent us from sharing otherwise material non-public information about our financial forecast. Restricted Shares Restricted shares vest ratably over a three-year period, beginning on the first anniversary of the date of grant. Performance Unit Vesting The 2018 award of performance units completed its three-year performance period. Payoutcycle as of December 31, 2020. The table below illustrates the structure of the performance units granted in 2018. | | | | | | | | | | | | Performance Measure | | Weighting | | Threshold | | Target | | Maximum | | Actual | Adjusted Diluted EPS | | 57% | | $6.44 | | $7.58 | | $8.72 | | $6.97 | Revenue Growth | | 43% | | $2,238M | | $2,356M | | $2,627M | | $2,516M |

As a result of the actual performance achieved, the Compensation Committee approved vesting of 102% of the original target number of performance units. 2021 Compensation Program Actions COVID-19 continues to impact our communities, our clients, our employees, and therefore our business, and the duration and severity of the ongoing disruption is unclear. As discussed, the Compensation Committee took a holistic view of the impact of COVID-19 on our business as well as on our NEOs’ compensation for 2020 and will continue to do so in 2021. The Committee approved design changes to certain aspects of the 2021 NEO compensation program, though the target pay opportunity remains 50% of target for threshold performance and 200% of target for maximum performance. No shares are earned for performance below threshold.levels remain unchanged from 2020. 20172021 Annual Performance Measures and Results:Incentive Program

The Compensation Committee establishedand management continue to believe that the NEOs should be critically focused on improving shareholder value through driving the profitable growth of the organization. As such, the Committee retained Organic Revenue Growth and Adjusted EBITDA Margin as the primary annual incentive financial metrics, with a combined 75% weighting. The Committee and management also recognize the importance of the nature by which these financial results are achieved and retained Strategic Measures to determine a portion of the award. For 2021, the Strategic Measures have been enhanced to include Environmental, Social and Governance (ESG) goals, increasing the weighting of the Strategic Measures category from 20% to 25% of the target NEO annual incentive opportunity. As in prior years, the majority of the Strategic Measures will be determined based on performance against objective, quantifiable goals. 2021 Long-Term Incentive Program For 2021, the Committee made two changes to the program design due to the ongoing uncertainty presented by the COVID-19 pandemic and the Committee’s desire to retain a competitive earning opportunity and shareholder alignment for the NEOs. Maintain majority weighting on performance units but temporarily reduce weighting from 70% to 60% of the target award value, to better reflect market competitive practices. Huron remains committed to having the majority of the NEOs’ long-term incentive award delivered in performance-based elements but, for 2021, acknowledges the criticality of delivering a pay opportunity more consistent with our competitive market for talent in retaining our executives. Retain three-year cumulative performance cycle and three-year cliff vesting, but set annual goals for both Revenue Growth and Adjusted Diluted EPS aswhich balances the focus on long-term profitable growth with the continued uncertainty resulting from the pandemic. Final payout will be determined at the end of the full three-year period and incorporate our performance measure for PSUs with payouts ranging from 0%against Committee-approved three-year Revenue growth goals. As in prior years, we cannot disclose these goals at this time due to 200%. Actual performance came in below the threshold; therefore, performance share units were not earned as presented in the chart below.their material, non-public nature. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2017 Performance Targets (1) | | | | | | Actual Performance | | | Measure | | 0% | | | 25% | | | 100% | | | 150% | | | | | | 200% | | | Actual | | | PSU

Earned

Percent | | Adjusted Diluted EPS | | <$ | 2.31 | | | $ | 2.31 | | | $ | 2.46 | | | $ | 2.76 | | | | | | | $ | 3.16 | | | $ | 2.15 | | | | 0 | % |

(1) | Actual Adjusted Diluted EPS is calculated on a continuing operations basis and excludes certain acquisitions completed in 2017.

| | SECTION 4 - ADDITIONAL INFORMATION ON OUR COMPENSATION PROGRAMS |

2018 NEO Compensation Program Design ChangesCompetitive Market Data

During 2017, we undertook a review of ourThe Committee reviews external market data to inform its decisions about NEO compensation program to ensure it continues to support our business and talent strategies, appropriately reflects peer practices, and aligns with shareholders in recognition of our ongoing transformation.

| 1. | Publicly reported compensation data from a Committee-approved peer group |

Based on this review,

| 2. | Survey data for similarly sized companies |

In October 2019, the Committee approved a number of changes to the NEO compensation program for 2018:following peer group companies: | | | 2018 Annual Incentive Program | Changes Made: | | Reasons for Change: | • Adding organic revenue growth as performance measure, replacing the budgeted revenue goal.CBIZ, Inc.

• Adding greater specificity to and limiting the number of strategic objectives.

• Widening the performance/payout range.

| | • Creates enhanced emphasis on the importance of top line growth in growing share price.

• Provides greater clarity to performance expectations and reduces subjectivity in assessing performance.

• Better reflects competitive practices while maintaining our performance focus by providing lower than typical payout for below target performance and by requiring greater performance for a maximum payout.Korn Ferry

|

The 2018 annual incentive program design is summarized below:

CRA International, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Threshold | | | Target | | | Maximum | | | Performance Measure | | Weighting | | | Performance | | | Payout | | | Performance | | | Payout | | | Performance | | | Payout | | Organic Revenue Growth | | | 40 | % | | | 95 | % | | | 25 | % | | | 100 | % | | | 100 | % | | | 111 | % | | | 200 | % | Adjusted EBITDA Margin | | | 30 | % | | | 85 | % | | | 25 | % | | | 100 | % | | | 100 | % | | | 115 | % | | | 200 | % | Strategic Measures* | | | 30 | % | | | 85 | % | | | 25 | % | | | 100 | % | | | 100 | % | | | 115 | % | | | 200 | % |

* At the beginning of 2018, the Compensation Committee approved specific strategic measures focused on further development of each practice area and further improvements in the effectiveness and efficiencies of Huron’s infrastructure. A target award would reflect full achievement of these objectives, as assessed by the Committee. The Committee applies its judgment in determining overall performance on the measure.

| | | 2018 Long-Term Incentive Program | Changes Made: | | Reasons for Change: | • Utilizing a full three-year performance measurement cycle.

• Adding a revenue growth goal to complement the adjusted EPS goal.

| | • Reflects multi-year performance rather than the sum of annual goals.

• Focuses on the importance of top line growth to drive shareholder value.LiveRamp Holdings, Inc.

|

The 2018 long-term incentive program design is summarized below:

| Exponent, Inc. | | | | | | | | | | | Vehicles | | Weighting | | | Performance Measure | | | | Performance/Vesting Timeline | Performance Units

| | | 70 | % | | 40% Adjusted Diluted EPS

30% Organic Revenue Growth | | Three-Year (cliff)Navigant Consulting, Inc. * | Restricted SharesFTI Consulting Inc.

| | NextGen Healthcare, Inc. | 30 | % Heidrick & Struggles International, Inc. | | Continued employmentPremier, Inc. | HMS Holdings Corp. | | Three-Year (ratable) |

Resources Connection, Inc. | SECTION 4 - ADDITIONAL DISCLOSURES RELATED TO COMPENSATION PROGRAMICF International, Inc. | | |

Executive Pay Peer Group

The peer group developed in 2016 to inform 2017 pay decisions was modified based on the annual review of Executive Pay Peer Group criteria. The Compensation Committee elected to expand the peer group from 11 companies to 16 companies. The Committee believes that this larger peer group will provide better insights into the compensation practices of business peers and will be less volatile due to the compensation changes made by one company. Companies were identified based on the following process:

| | 1.* | All companiesNavigant was acquired in October 2019, but had filed a proxy in 2019 that provided NEO pay data. athenahealth and Dun & Bradstreet, which were identified that metin the following criteria:peer group prior to October 1, 2019, were each acquired and taken private in Feb. 2019 – since no 2019 proxies were published, compensation data was no longer available. LiveRamp Holdings was previously named Acxiom Corporation.

|

US headquartered and publicly traded.

Revenue betweenThe peer companies represent one-halfbusiness-to-business to two times Huron’s trailing 12 months’ revenue as of Huron’s 2016 fiscalyear-end.

Global Industry Classification Standard (GICS) codes:service providers in the Research and Consulting Services, Human Resource &and Employment Services, Application Software,Health Care Technology, Health Care Services, or Technology, or Data ProcessingIT Consulting and Outsourced Services.Other Services industry sectors with:

| 2. | Companies were then screened

Revenues from 0.4x to 2.5x Huron’s revenues and selected that best met the following set of factors: |

Business and/or labor market competitor to Huron.

Similar revenue per employee.

Predominantly US revenue.

Principal business wasMarket capitalization 0.1x to provide value-added consulting or advisory services to companies and organizations.5x Huron’s market capitalization

As a result ofSurvey data represents companies with revenues between $500 million and $1 billion from the review and application of these criteria, the Compensation Committee approved the following companies:

Allscripts Healthcare Solutions, Inc.

Dun & Bradstreet Corporation

Heidrick & Struggles International, Inc.

Resources Connection, Inc.

Additional changes were made to the peer group in 2017 in advance of 2018 pay determination. Gartner acquired CEB, thus the Committee removed CEB as a peer, and the Committee elected to remove Gartner and Maximus due to their larger size relative to Huron. Lastly, Acxiom Corporation and HMS Holdings Corporation were added to maintain a peer group of robust size.Radford Global Technology Survey.

Employment Agreements with Mr. Roth, Mr. Hussey, Mr. Kelly and Ms. Ratekin Huron has entered into agreements with each of the named executive officers that provide for benefits upon termination of employment under certain circumstances, including in connection with a change of control of the Company. Huron provides these benefits as a means of remaining competitive, retaining executive officers, focusing executive officers on shareholder interests when considering strategic alternatives, and providing income protection in the event of involuntary loss of employment. In general, these arrangements provide for severance benefits upon Huron’s termination of the executive’s employment without cause or resignation by the executive for good reason (constructive termination). In the event of a change of control of Huron and if the executive’s employment is terminated without cause or he or she resigns for good reason, the executive will receive enhanced severance benefits. Huron provides these enhanced severance benefits only with a “double trigger” because the Company believes that the executive officers would be materially harmed in a change of control only if it results in reduced responsibilities or compensation or loss of employment for the executive. Huron employment agreements do not provide for any gross-ups. More information on our use of employment agreements, including the estimated payments and benefits payable to the named executive officers, is provided under the “Potential Payments Upon Termination or Change of Control” section of this Proxy Statement. Role of Compensation Committee The Compensation Committee is primarily responsible for administering our executive compensation program in a manner consistent with our compensation philosophy and objectives. The principal functions of the Compensation Committee are to: set salaries and annual and long-term incentive levels for the CEO and other named executive officers;

evaluate annually the performance of the CEO (in coordination with the full board) and review the CEO evaluations of the other named executive officers;

review and approve the design and competitiveness of our compensation plans, executive benefits and perquisites;

review and approve the total cash and stock bonus pools for the organization, and approve the individual incentive payout awards for the named executive officers;

| | ��• | set salaries and annual and long-term incentive levels for the CEO and other named executive officers, so that the program is promoting shareholder value; |

| • | evaluate annually the performance of the CEO (in coordination with the full board) and review the CEO evaluations of the other named executive officers; |

| • | review and approve the design and competitiveness of our compensation plans, executive benefits and perquisites; |

| • | review and approve the total cash and stock bonus pools for the organization, and approve the individual incentive payout awards for the named executive officers; |

| • | review director compensation and make recommendations to the board; |

review and approve goals used for the annual and long-term incentive plans;

retain or terminate, in its sole discretion, any independent compensation consultant used to assist the Compensation Committee;

review and evaluate compensation arrangements to assess whether they could encourage undue risk taking; and

create a Compensation Committee report on executive compensation for inclusion in the Proxy Statement.

| • | review and approve goals used for the annual and long-term incentive plans; |

| • | retain or terminate, in its sole discretion, any independent compensation consultant used to assist the Compensation Committee; |

| • | review and evaluate compensation arrangements to assess whether they could encourage undue risk taking; and |

| • | create a Compensation Committee report on executive compensation for inclusion in the Proxy Statement. |

The Compensation Committee acts independently and works closely with our board of directors and the executive management team in making many of its decisions. To support its decision making, the Compensation Committee has retained the services of an independent compensation consultant. The Compensation Committee has the sole authority to amend or terminate the services of its independent consultant. In 2017,2020, the Compensation Committee was comprised entirely of independent directors, none of whom has at any time been an officer or employee of the Company.directors. Role of Management Our CEO works together with the Corporate Vice President, Chief Human Resources Officer and the Compensation Committee of our board to establish, review and evaluate compensation packages and policies for our executive officers. Our CEO reviews the performance of each named executive officer and makes recommendations to the Compensation Committee based on his review. Our CEO, COO and President, CFO and General Counsel provide input into our strategic goals for future performance periods. The Compensation Committee carefully reviews all information before finalizing incentive goals, however, as we believe such a process is consistent with good governance. Prior to determining the size of the bonus pool for all employees other than NEOs, management reviews Company and practice-level performance with the Chairman of the board so that the bonus pool and Company profitability strike the right balance between shareholder returns and retention of employees. Our CEO does not participate in any discussionsthe decisions related to his own compensation. Role of Compensation Advisor The Compensation Committee retains an independent advisor to assist in the ongoing assessment of our executive compensation strategy and program. The Committee’s independent advisor reports directly to the Compensation Committee and serves at its sole discretion and does not perform any services for the Company other than those in connection with its work for the Compensation Committee. Semler Brossy servedPay Governance serves as the Compensation Committee’s independent advisor through the first half of 2017, at which time the Compensation Committee retained Pay Governance to serve as its independent advisor. The Compensation Committee annually analyzesassesses whether the compensationindependent advisor’s work has raised any conflict of interest. The Compensation Committee has determined, based on its analysis of NASDAQ requirements, that the work of Semler Brossy and Pay Governance and the individual compensation advisors employed by Semler Brossy and Pay Governance as compensation consultants to the Company has not created any conflict of interest. 2017 Say on Pay Vote

In 2017, we received a shareholder advisory vote (commonly referred to as “Say on Pay”) in excess of 99% in support of the named executive officer compensation. We believe this positive vote reflects the strong pay for performance relationship in our executive compensation program and supports the changes that have been made in recent years to improve the program. We continue to listen carefully to our shareholders and incorporate their feedback into our deliberations about executive compensation. As in 2011, shareholders at the 2017 Annual Meeting expressed a preference that advisory votes on executive compensation occur every year. Consistent with this preference, the Company has held and will continue to hold its advisory vote on the compensation of the Company’s named executive officers annually until the 2023 Annual Meeting at which time shareholders will again be asked to vote on the frequency of advisory votes on named executive officer compensation.

Health and Welfare Benefits The named executive officers are eligible for the same health and welfare benefits generally available to Huron employees. Deferred Compensation The Company also offers a nonqualified deferred compensation plan (the “DCP”) to all managing directors, corporate vice presidents, named executive officers andnon-employee directors. The DCP allows managing directors, corporate vice presidents and executivesparticipants to elect to defer up to 75% of their base salary and 100% of their annual cash incentive into a deferred compensation account and to choose from a number of investment alternatives.Non-employee directors may elect to defer up to 100% of their board fees into the DCP. Earnings are credited based on the returns of the investment options selected by the participant. Any amounts contributed may be deferred until a later date or may become payable in connection with a participant’s retirement, death, disability or other separation from service. Perquisites Huron did not provide materialprovides very limited perquisites to named executive officers that are not provided widely within HuronHuron. In response to any named executive officerthe COVID-19 pandemic, Mr. Roth used a company aircraft on one occasion in 2017.2020 for personal travel to maintain his health and safety. The incremental cost of Mr. Roth’s personal use of the company aircraft is included as a perquisite in the Summary Compensation Table under the heading “All Other Compensation.” In addition, the Company provides enhanced disability and life insurance benefits to all of its managing directors, corporate vice presidents and executive officers. The CEONamed executive officers and Executive Vice Presidentspractice leaders are also offered reimbursement of the cost of an annual executive physical examination. Clawback Provisions In 2014, we adopted an incentive compensation recoupment policy (commonly referred to as a “clawback policy”) that provides for the potential recoupment of bonuses or awards paid to executive officers and such other individuals designated by our independentnon-employee directors under our short-term and long-term incentive compensation plans, where the payout or actual award received was determined based in part on the financial performance of the Company. In the event of a material restatement of our quarterly or annual financial results, our independentnon-employee directors will review all incentive compensation awarded to those individuals covered by the policy based upon the achievement of financial results that were the subject of the restatement. The independentnon-employee directors have the authority to recoup all or a portion of the incentive compensation to the extent that the amount of such compensation would have been lower than the amount actually awarded, granted, paid, earned, deferred or vested based on the achievement of financial results that were subsequently reduced due to such restatement. Stock Ownership Guidelines and Holding Requirements In 2010,2018, the Compensation Committee adoptedrevised stock ownership guidelines for Huron’s named executive officers andnon-employee directors. The guidelines, set forth below, are consistent with peer practices and designed to promote alignment with the interests of stockholders and the Company’s commitment to sound corporate governance. | | | | Position | | Stock Ownership Guideline | CEO | | the lesser of 3x5x salary or 120,000 shares | COO and CFO | | the lesser of 2x salary or 50,000 shares | Other Executive Officers | | the lesser of 1x salary or 20,000 shares | Non-employee directors

(elected prior to 2014 annual meeting)Directors | | 5x the lesser of 3x annual retainer or 9,000 shares | Non-employee directors

(elected on or after 2014 annual meeting)

| | the lesser of 3x annual retainer or the # of shares equivalent to 3x annual retainer/share price on day prior to annual meeting when first elected$60,000 |

Until the relevant stock ownership target is achieved, executive officers andnon-employee directors are required to retain a number of shares equal to at least 60% of the net after tax proceeds from the exercise of stock options or vesting of restricted stock and performance shares.units. Only shares owned outright count towards ownership requirements. Unexercised stock options and unvested performance sharesunits or unvested restricted stock do not count. All of our NEOs andnon-employee directors are in compliance with the terms of our share ownership guidelines. Hedging and Pledging The Company has an insider trading policy that prohibits directors, officers, employees and contractors from entering into transactions in publicly traded puts, calls or other derivative securities with respect to Huron’s stock and prohibits any other transaction that “hedges” the ownership in Huron’s stock or holding Company securities in a margin account or pledging Company securities as collateral for a loan. Tax Considerations Section 162(m). Section 162(m) of the Code generally disallows a tax deduction to public companies for compensation paid in excess of $1 million for any fiscal year to certain specified covered employees. Undera company’s chief executive officer or other named executive officers (excluding the rulescompany’s principal financial officer, in effectthe case of tax years commencing before 2018). However, in the case of tax years commencing before 2018, the statute exempted qualifying performance-based compensation that qualified as “performance-based compensation” underfrom the deduction limit if certain requirements were met. Section 162(m) was deductible without regard to this $1 million limit. The recentamended in December 2017 by the Tax Cuts and Jobs Act generally eliminatedto eliminate the exemption for performance-based compensation (other than with respect to payments made pursuant to certain “grandfathered” arrangements entered into prior to November 2, 2017) and to expand the group of current and former executive officers who may be covered by the deduction limit under Section 162(m). While the Company’s shareholder approved incentive plans were previously structured to provide that certain awards could be made in a manner intended to qualify for the performance-based compensation exception under Section 162(m), effective January 1, 2018, subjectexemption, that exemption will no longer be available for future tax years (other than with respect to a special rule that “grandfathers” certain awards and“grandfathered” arrangements that were in effect on or before November 2, 2017. To date,as noted above). In addition, while the IRS has not issued guidance interpreting the Tax Cuts and Jobs Act. While theCompensation Committee intended that certain incentive awards granted to our NEOs on or prior to November 2, 2017 be deductible as “performance-based compensation,”compensation” and has assessed the possibility that certain awards will be grandfathered from the changes made by the Tax Cuts and Jobs Act, it cannot assureguarantee that result. The Compensation Committee has taken the potential impact of the Tax Cuts and Jobs Act into consideration when approving payout amounts for performance periods ending on December 31, 2017.2020. The Compensation Committee expects in the future to authorize compensation in excess of $1 million to named executive officers that will not be deductible under Section 162(m) when it believes doing so is in the best interests of the Company and its shareholders. Section 280G. Section 280G of the Code disallows a company’s tax deduction for certain payments in connection with a change of control defined as “excess parachute payments,” and Section 4999 of the Code imposes a 20% excise tax on certain persons who receive excess parachute payments. The Compensation Committee amended Senior Management Agreements in 2010 to ensure that any covered payments would be reduced to the extent necessary so that no portion of such payments is subject to the excise tax. COMPENSATION COMMITTEE REPORT The Compensation Committee has reviewed and discussed with management the information contained under the caption “Compensation Discussion and Analysis” and, based on this review and discussion, has recommended to the board of directors that it be included in this Proxy Statement and incorporated by reference into our 20172020 Annual Report on Form10-K. Debra Zumwalt, Chair H. Eugene Lockhart John S. MoodyHugh E. Sawyer

Ekta Singh-Bushell | | | REQUIRED COMPENSATION DISCLOSURES |

20172020 SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | Name and Principal Position | | Year | | Salary

($) | | Non Equity

Incentive Plan

Compensation

($) | | Stock

Awards

($)(1) | | | Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings

($)(2) | | All Other

Compensation

($)(3) | | Total

Compensation

($) | | James H. Roth | | 2017 | | 900,000 | | 595,980 | | | 2,699,973 | | | 308,563 | | 31,434 | | | 4,535,950 | | President and Principal Executive Officer | | 2016 | | 900,000 | | 207,900 | | | 1,939,930 | | | 83,903 | | 27,109 | | | 3,158,842 | | | | 2015 | | 900,000 | | 594,000 | | | 2,662,934 | | | 0 | | 31,134 | | | 4,188,068 | | C. Mark Hussey | | 2017 | | 743,750 | | 451,500 | | | 2,312,472 | | | 150,059 | | 30,985 | | | 3,688,766 | | Executive Vice President and Principal Operating Officer | | 2016 | | 600,000 | | 126,000 | | | 1,005,895 | | | 60,624 | | 26,435 | | | 1,818,954 | | | | 2015 | | 550,000 | | 297,000 | | | 904,174 | | | 0 | | 30,905 | | | 1,782,079 | | John D. Kelly (4) | | 2017 | | 323,333 | | 136,955 | | | 344,197 | | | N/A | | 23,113 | | | 827,598 | | Executive Vice President and Principal Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Diane E. Ratekin | | 2017 | | 400,000 | | 120,400 | | | 460,003 | | | 18,353 | | 31,719 | | | 1,030,475 | | Executive Vice President, General Counsel and Corporate Secretary | | 2016 | | 400,000 | | 42,000 | | | 438,686 | | | 6,411 | | 35,221 | | | 922,318 | | | | 2015 | | 400,000 | | 120,000 | | | 473,415 | | | 0 | | 30,635 | | | 1,024,050 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | Name and Principal Position | | Year | | Salary

($) | | Bonus

($)(6) | | | Non Equity

Incentive Plan

Compensation

($) | | | Stock

Awards

($)(1)(2) | | | All Other

Compensation

($)(5) | | | Total

Compensation

($) | | James H. Roth | | 2020 | | 947,917 | | | 394,478 | | | | 470,022 | | | | 2,137,486 | | | | 41,543 | | | | 3,991,446 | | Chief Executive Officer | | 2019 | | 900,000 | | | | | | | 1,285,614 | | | | 2,024,994 | | | | 32,954 | | | | 4,243,562 | | | | 2018 | | 900,000 | | | | | | | 1,158,597 | | | | 2,700,010 | | | | 32,654 | | | | 4,791,261 | | C. Mark Hussey | | 2020 | | 797,917 | | | 237,280 | | | | 282,720 | | | | 1,400,009 | | | | 32,650 | | | | 2,750,576 | | President and | | 2019 | | 750,000 | | | | | | | 973,950 | | | | 1,312,515 | | | | 31,575 | | | | 3,068,040 | | Chief Operating Officer | | 2018 | | 750,000 | | | | | | | 877,725 | | | | 1,312,500 | | | | 31,750 | | | | 2,971,975 | | John D. Kelly | | 2020 | | 522,292 | | | 140,144 | | | | 166,982 | | | | 1,537,500 | | | | 26,677 | | | | 2,393,595 | | Executive Vice President, Chief Financial Officer and Treasurer | | 2019 | | 457,500 | | | | | | | 418,149 | | | | 690,001 | | | | 25,473 | | | | 1,591,123 | | | | 2018 | | 396,875 | | | | | | | 327,684 | | | | 479,999 | | | | 20,156 | | | | 1,224,714 | | Ernest W. Torain, Jr.(3) Executive Vice President, General Counsel and Corporate Secretary | | 2020 | | 285,000 | | | 53,388 | | | | 63,612 | | | | 423,985 | | | | 25,537 | | | | 851,522 | | Diane E. Ratekin(4) | | 2020 | | 400,000 | | | | | | | 200,000 | | | | 138,025 | | | | 33,016 | | | | 771,041 | | Former Executive Vice President, | | 2019 | | 400,000 | | | | | | | 259,720 | | | | 459,984 | | | | 57,519 | | | | 1,177,223 | | General Counsel and | | 2018 | | 400,000 | | | | | | | 234,060 | | | | 460,013 | | | | 35,395 | | | | 1,129,468 | | Corporate Secretary | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | This column represents the aggregate grant date fair value of restricted stock and/or performance share unit awards. The value of the performance share units in the table is consistent with the estimate of aggregate compensation cost to be recognized over the service period determined as of the grant date under FASB ASC Topic 718. |

| (2) | The amounts in this column represent investment gains in the deferred compensation plan. Huron does not offerIncludes a pension plan. The amount shown above represents that portion of the account earnings that exceeded the SEC benchmark “market” rate equal to 120% of the long-term applicable federal rate (based on the average rate for 2017, 2016 and 2015 of 2.72%, 2.70% and 3.05%, respectively). For 2017, the actual earningsspecial time-vested award for Mr. Roth,Kelly and a special time-vested new hire award for Mr. Hussey and Ms. Ratekin were $385,248, $177,842 and $22,149, respectively. Mr. Roth began participation in the deferred compensation plan in 2015. Mr. Hussey began participation in the plan in 2014. Ms. Ratekin’s earnings relate to amounts contributed to the plan prior to her becoming a named executive officer. Please see the section entitled “2017 Nonqualified Deferred Compensation” below for more detail.Torain. See 2020 Grants Plan-Based Awards table below.

|

| (3) | Mr. Torain has served as Executive Vice President, General Counsel, and Secretary since March 1, 2020. |

| (4) | Ms. Ratekin served as Executive Vice President, General Counsel, and Secretary. As part of her retirement agreement with the Company, Ms. Ratekin’s Non-Equity Incentive Plan Award for 2020 will be paid at target. On September 12, 2019, Ms. Ratekin entered into a Transitional Retirement Agreement in connection with her intention to retire as Executive Vice President, General Counsel and Corporate Secretary of the Company. To facilitate a smooth transition, Ms. Ratekin agreed to continue to serve as Executive Vice President, General Counsel and Corporate Secretary until her successor was appointed. In 2020, Ms. Ratekin received a base salary of $400,000 and an annual bonus fixed at $200,000 paid in cash and $138,000 in restricted stock, along with other welfare benefits and executive perquisites. Mr. Torain was appointed as Ms. Ratekin’s successor effective March 1, 2020 and she serves as an advisor to the board of directors of the Company and Mr. Torain until April 1, 2021. |

| (5) | All Other Compensation for 20172020 is detailed in the table below. |

(4)(6) | On January 3, 2017, Mr. Kelly was promotedThe amounts in this Bonus column for 2020 represent discretionary awards determined by the Committee. For additional detail related to the positiondetermination of Executive Vice Presidentthese awards, please refer to the “2020 Annual Incentive Award” section of the Compensation Discussion and Chief Financial Officer. Formerly, Mr. Kelly had been Corporate Vice President and Chief Accounting Officer.Analysis.

|

20172020 All Other Compensation

| | Name | | Executive Long-

Term Disability

($)(1) | | Executive $1MM Term Life Insurance

($)(2) | | Company Provided

401(k) Match

($)(3) | | Other Benefits

and

Perquisites

($)(4) | | Total All

Other

Compensation

($) | | | Executive Long-

Term Disability

($)(1) | | Executive $1MM Term Life

Insurance ($)(2) | | Company Provided

401(k) Match

($)(3) | | Other Benefits

and

Perquisites

$(4) | | Total All Other

Compensation ($) | | James H. Roth | | | 6,776 | | | | 4,433 | | | | 16,200 | | | | 4,025 | | | | 31,434 | | | | 6,777 | | | | 4,433 | | | | 17,100 | | | | 13,233 | | | | 41,543 | | C. Mark Hussey | | | 7,101 | | | | 3,204 | | | | 16,200 | | | | 4,480 | | | | 30,985 | | | | 7,101 | | | | 3,204 | | | | 17,100 | | | | 5,245 | | | | 32,650 | | John D. Kelly | | | 1,830 | | | | 1,058 | | | | 16,200 | | | | 4,025 | | | | 23,113 | | | | 3,749 | | | | 1,058 | | | | 17,100 | | | | 4,770 | | | | 26,677 | | Ernest W. Torain, Jr. | | | | 1,759 | | | | 3,708 | | | | 15,300 | | | | 4,770 | | | | 25,537 | | Diane E. Ratekin | | | 7,952 | | | | 7,487 | | | | 16,200 | | | | 80 | | | | 31,719 | | | | 8,428 | | | | 7,488 | | | | 17,100 | | | | 0 | | | | 33,016 | |

| (1) | Executive Long-Term Disability is provided to all executives and managing directors. |

| (2) | Executive Term Life Insurance is provided to all executives and managing directors. |

| (3) | Huron provides a Company 401(k) match to all participating employees. |

| (4) | Other Benefits and Perquisites includesinclude the cost of an executive physical,physicals, which Huron pays for executives and certain managing directors, and with respect to Mr. Roth, his personal use of a wellness benefit available to all employees that reimburses up to $320 annually for purchases that assist in maintaining work-life balance. The wellness benefit was discontinued as of June 2017.company aircraft. |

CEO Pay Ratio As a resultrequired by Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, beginning with our 2018 Proxy Statement, the SEC will requireCompany is providing the following disclosure about the relationship of the CEO to median employee pay ratio. Mr. Roth received 2017 annual total compensation of $4,535,950our median-paid employee to the annual total compensation of Mr. Roth, our CEO. We believe that the pay ratio disclosed below is a reasonable estimate calculated in a manner consistent with Item 402(u) of Regulation S-K. SEC rules for identifying the median employee and calculating the pay ratio allow companies to apply various methodologies and apply various assumptions and, as a result, the pay ratio reported by us may not be comparable to the pay ratio reported by other companies.

For 2020 The annual total compensation of our median employee, was $142,706. Mr. Roth’s annual total compensation, as reflected in the Summary Compensation Table included in this Proxy Statement. OurStatement, was $3,983,458. Based on this information, the ratio of the annual total compensation of Mr. Roth to the annual total compensation of our median employee’semployee is estimated to be 27.9 to 1. The calculation of the 2020 CEO Pay Ratio used the same median employee as used in 2019. As permitted by SEC rules, we used the same median employee that was identified in the preparation of our pay ratio in 2019 because there has been no change in our employee population or compensation arrangements that we believe would significantly impact our pay ratio disclosure. In 2019, we identified the median employee by examining the 2019 total compensation for all individuals using the same methodology we use for our NEOs as set forth in the 2019 Summary Compensation Table, excluding our CEO, who were employed by us on December 31, 2019. We included all employees, whether employed on a full-time or part-time basis. We annualized the base compensation and bonus for all employees that were not employed by us for all of 2019 unless they were designated as temporary or seasonal positions. In addition, in order to identify our median employee in 2019, we (i) utilized the exemption permitted under Item 402(u) of Regulation S-K to exclude a total of 140 employees from Canada, the United Kingdom, Singapore, and Switzerland (which, in the aggregate, comprised less than 5% of our total employee population as of December 31, 2019), resulting in a net employee population of 3,811 and (ii) adjusted non-U.S. employee pay applying foreign currency exchange rates as of December 31, 2019. When identifying the median employee for the 2019 Proxy Statement, we included all forms of compensation, including one-time, special and retention awards to identify our median employee. This resulted in identifying a median employee with compensation substantially similar to that of our median employee in the prior year. We calculated 2020 annual total compensation for 2017 was $118,710. As a result, we estimate that Mr. Roth’s 2017 annual total compensation was approximately 38 times that of our median employee.employee using the same methodology we use for our NEOs as set forth in the Summary Compensation Table. 20172020 GRANTSOF PLAN-BASED AWARDS

The following table summarizes the grants of equity awards and annual cash incentive awards for 20172020 to each named executive officer. | | | | | | | | | Estimated Future Payouts

Under Non-Equity Incentive

Plan Awards (1) | | | | | Estimated Future Payouts

Under Equity Incentive Plan Awards (2) | | | | | | | | | | | | Estimated Future Payouts Under Non Equity Incentive Plan Awards (1)(6) | | | | | Estimated Future Payouts Under Equity Incentive Plan Awards (2) | | | | | | | Name | | Grant Date | | Date of

Compensation

Committee

Action | | | Threshold

($) | | Target ($) | | Maximum

($) | | | | | | Threshold

(#) | | Target (#) | | Maximum

(#) | | | All Other

Stock

Awards:

Number of

Shares of

Stock

(#)(3) | | Full Grant

Date Fair

Value of

Each

Award

($)(4) | | | Grant Date | | Date of Compensation Committee Action | | | Threshold ($) | | Target ($) | | Maximum ($) | | | | | | Threshold (#) | | Target (#) | | Maximum (#) | | | All Other Stock

Awards:

Number of

Shares of

Stock (#)(3) | | Full Grant

Date Fair

Value of

Each

Award

($)(4) | | James H. Roth | | | 3/15/2017 | (5) | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | 13,863 | | | | 27,726 | | | | 55,452 | | | | — | | | | 1,133,993 | | | | 3/1/2020 | | | | 2/20/2020 | | | | — | | | | — | | | | — | | | | | | 6,304 | | | | 25,215 | | | | 50,430 | | | | — | | | | 1,496,258 | | | | | 3/15/2017 | (6) | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | 9,242 | | | | 18,484 | | | | 36,968 | | | | — | | | | 755,996 | | | | 3/1/2020 | | | | 2/20/2020 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 10,806 | | | | 641,228 | | | | | 3/15/2017 | | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 19,804 | | | | 809,984 | | | | | | | | 332,500 | | | | 1,330,000 | | | | 2,660,000 | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | | | | | 247,500 | | | | 990,000 | | | | 1,485,000 | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | C. Mark Hussey | | | 3/15/2017 | (5) | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | 6,739 | | | | 13,478 | | | | 26,956 | | | | — | | | | 551,250 | | | | 3/1/2020 | | | | 2/20/2020 | | | | — | | | | — | | | | — | | | | | | 4,129 | | | | 16,515 | | | | 33,030 | | | | — | | | | 980,000 | | | | | 3/15/2017 | (6) | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | 4,493 | | | | 8,985 | | | | 17,970 | | | | — | | | | 367,487 | | | | | | 3/15/2017 | | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 9,627 | | | | 393,744 | | | | | | 8/21/2017 | | | | 8/17/2017 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 32,051 | | | | 999,991 | | | | 3/1/2020 | | | | 2/20/2020 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 7,078 | | | | 420,009 | | | | | | | | | 187,500 | | | | 750,000 | | | | 1,125,000 | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | | | | 200,000 | | | | 800,000 | | | | 1,600,000 | | | | | | — | | | | — | | | | — | | | | — | | | | — | | John D. Kelly | | | 3/1/2017 | | | | 2/10/2017 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 442 | | | | 19,205 | | | | 3/1/2020 | | | | 2/20/2020 | | | | — | | | | — | | | | — | | | | | | 2,323 | | | | 9,290 | | | | 18,580 | | | | — | | | | 551,269 | | | | | 3/15/2017 | (5) | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | 1,669 | | | | 3,337 | | | | 6,674 | | | | — | | | | 136,483 | | | | 3/1/2020 | | | | 2/20/2020 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 3,981 | | | | 236,233 | | | | | 3/15/2017 | (6) | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | 1,113 | | | | 2,225 | | | | 4,450 | | | | — | | | | 91,003 | | | | 3/1/2020 | | | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 12,639 (5) | | | | 749,998 | | | | | 3/15/2017 | | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 2,384 | | | | 97,506 | | | | | | | | 118,125 | | | | 472,500 | | | | 945,000 | | | | | | — | | | | — | | | | — | | | | — | | | | — | | Ernest W. Torain, Jr. | | | | 4/1/2020 | | | | 3/23/2020 | | | | — | | | | — | | | | — | | | | | | 1,305 | | | | 5,220 | | | | 10,440 | | | | | | 226,809 | | | | | | 4/1/2020 | | | | 3/23/2020 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 2,237 | | | | 97,198 | | | | | | 4/1/2020 | | | | 3/23/2020 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 2,301 | | | | 99,978 | | | | | | | | | 56,875 | | | | 227,500 | | | | 341,250 | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 4/1/2020 | | | | | | 45,000 | | | | 180,000 | | | | 360,000 | | | | | | — | | | | — | | | | — | | | | — | | | | Diane E. Ratekin | | | 3/15/2017 | (5) | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | 2,362 | | | | 4,724 | | | | 9,448 | | | | — | | | | 193,212 | | | | 3/1/2020 | | | | 2/20/2020 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 2,326 | | | | 138,025 | | | | | 3/15/2017 | (6) | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | 1,575 | | | | 3,149 | | | | 6,298 | | | | — | | | | 128,794 | | | | | | | | 50,000 | | | | 200,000 | | | | 400,000 | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | 3/15/2017 | | | | 2/20/2017 | | | | — | | | | — | | | | — | | | | | | — | | | | — | | | | — | | | | 3,374 | | | | 137,997 | | | | | | | | | | | 50,000 | | | | 200,000 | | | | 300,000 | | | | | | — | | | | — | | | | — | | | | — | | | | — | | |

| (1) | For the cash award, the target, threshold and maximum represent the range of cash award that could be earned. There is no payout if a threshold level of performance is not achieved. The minimum amount that could be paid is 25% of target and maximum represents 150%200% of target. Based on the achievement of specific financial goals, the Compensation Committee determined that 60%65% of the target award was earned.earned for 2020. |

| (2) | The 20172020 grant of Performance ShareStock Units (PSUs) consists of two components: aone-year component based on 2017 performance and a three-year component based on 2017-2019 performance. The PSUs that comprise theone-year component are earnedis based on performance for the 2017 performance period. These(Adjusted Diluted EPS and Revenue Growth) over a three-year period from 2020-2022. The PSUs are earned from 50%25% of target for threshold performance to 200% of target for maximum performance; however, if threshold performance is not achieved, the award will be forfeited. The PSUs that comprise theone-year component that are earned are then subject to vesting based on continued employment withone-third of the earned award vesting each year following the 2017 performance period, commencing March 15, 2018. The PSUs that comprise the three-year component are earned based on 2017-2019 performance. These PSUs are earned from 50% of target for threshold performance to 200% of target for maximum performance; however, if threshold performance is not achieved, the award will be forfeited. The PSUs that comprise the three-year component that are earned vest on March 15, 2020.1, 2023. |

| (3) | Restricted stock granted under the Company’s 2012 Omnibus Incentive Plan. |

| (4) | The full grant date fair value of the March 1, 2017 RSA is based on the closing price of Huron2020 and April 1, 2020 restricted stock of $43.45 on February 28, 2017. The full grant date fair values of the March 15, 2017 RSAs and PSUsPSU grants are based on the closing price of Huron stock of $40.90$59.34 on March 14, 2017.February 28, 2020 and $43.45 on April 1, 2020. The total number of sharesPSUs earned by recipients of these awards wasis contingent on meeting Adjusted Diluted EPS and Revenue Growth goals as described in Note (2) above. |

| (5) | The March 15, 2017Restricted stock that will vest 100% four years from the date of grant of PSUs consists of two components, aone-year component forprovided Mr. Kelly is still employed by Huron on the 2017 performance period and a three-year component for the 2017-2019 performance period. This row reports information for theone-year component of the award for 2017.applicable vesting date.

|

| (6) | The March 15, 2017 grantAs part of PSUs consists of two components, aher retirement agreement with the Company, Ms. Ratekin’s one-yearNon-Equity componentIncentive Plan Award for the 2017 performance period and a three-year component for the 2017-2019 performance period. This row reports information for the three-year component of the award for the 2017-2019 performance period.2020 will be paid at target.

|

20172020 OUTSTANDING EQUITY AWARDSAT FISCAL YEAR-E-NDEND